The Importance of Investor Agreements

A shareholder agreement is a crucial document that outlines the rights, responsibilities, and obligations of shareholders within a company. This guide explains the significance of crafting effective Investor Agreements in Australia, ensuring that all parties’ interests are safeguarded and the company’s structure is solid.

Understanding Shareholder Agreements

Investor Agreements define the relationship between shareholders and the company.

1. Definition: A shareholder agreement is a legally binding contract that sets out the terms governing the relationship between the company’s shareholders.

2. Types: These agreements can be tailored for different types of companies, including startups, established businesses, and joint ventures.

3. Legal Framework: The enforceability of Investor Agreements in Australia relies on precise drafting and compliance with corporate laws.

Key Elements of a Shareholder Agreement

Including essential elements in a shareholder agreement ensures clarity and legal protection.

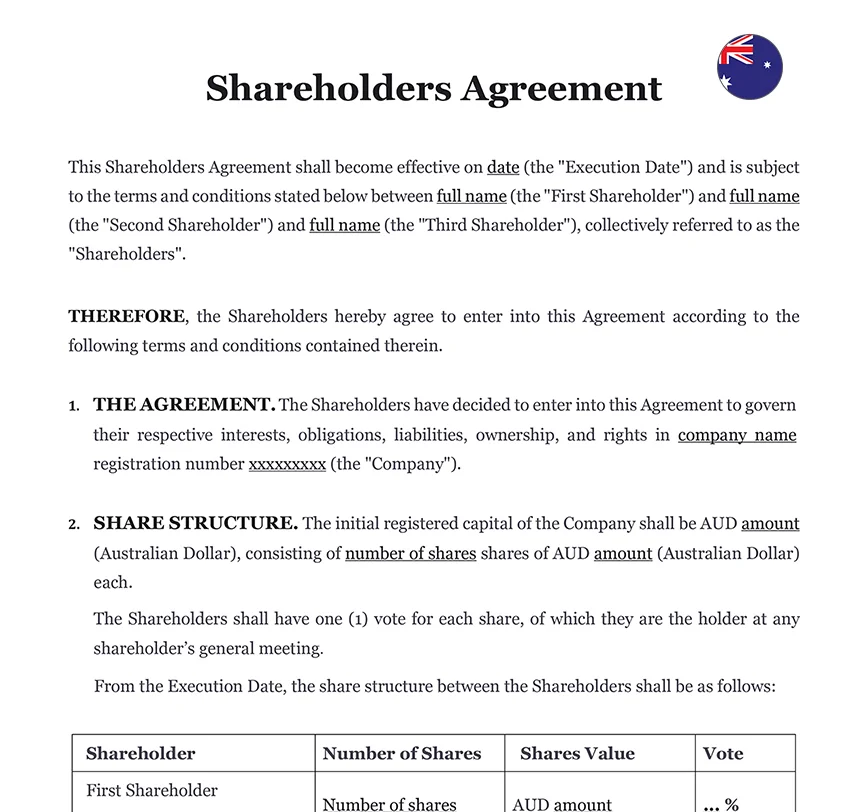

1. Parties Involved: Clearly identify all shareholders involved in the agreement.

2. Share Ownership: Specify the ownership structure and the number of shares held by each shareholder.

3. Rights and Responsibilities: Define the rights, responsibilities, and obligations of each shareholder.

4. Decision-Making: Outline the decision-making process, including voting rights and procedures.

5. Dividends: Establish the policy for dividend distribution and reinvestment of profits.

Protecting Minority Shareholders

Ensuring protection for minority shareholders helps maintain fairness and balance.

1. Veto Rights: Grant minority shareholders veto rights on major decisions.

2. Tag-Along Rights: Include tag-along rights to protect minority shareholders if majority shareholders sell their shares.

3. Preemptive Rights: Provide preemptive rights to allow minority shareholders to maintain their ownership percentage during new share issuances.

4. Dispute Resolution: Establish a process for resolving disputes among shareholders.

For further insights into structuring agreements that protect your interests, you can refer to our article on Drafting Purchase Agreements That Protect Your Interests, which offers detailed information on creating legally sound contracts.

Transfer of Shares

Addressing share transfer procedures ensures smooth transitions and protects company stability.

| ➤ Restrictions on Transfer: Include restrictions on the transfer of shares to maintain control over ownership. |

| ➤ Right of First Refusal: Provide existing shareholders with the right of first refusal if a shareholder wishes to sell their shares. |

| ➤ Buy-Sell Agreements: Outline buy-sell agreements to handle the transfer of shares in events such as death, disability, or retirement. |

| ➤ Valuation Methods:Define the methods for valuing shares during transfers. |