Ready to use legal template

Work on without any hassle

Compliant with Australian law

Ready to use legal template

Work on without any hassle

Compliant with Australian law

Home › Accounting › Invoice

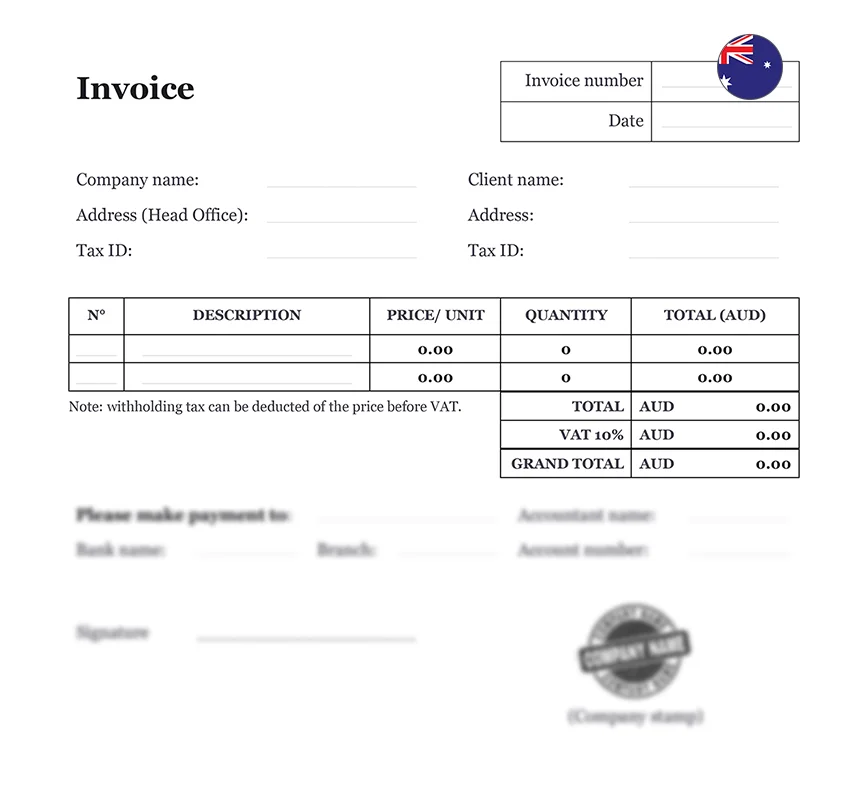

Learn more about Invoice in Australia

An Invoice is a formal document issued by a seller to a buyer detailing the goods or services provided, along with the corresponding payment terms. It serves as a crucial financial record for businesses, ensuring proper accounting, tax compliance, and smooth transactions. In Australia, invoices must meet specific legal requirements, including the inclusion of an Australian Business Number (ABN) and GST details for taxable sales. Proper invoicing helps businesses track payments, manage cash flow, and fulfill obligations under the Australian Taxation Office (ATO) regulations. Download our Invoice Form, easy to edit in Word format, professionally drafted for use in Australia, ensuring accuracy and compliance with local business and tax regulations.

Table of contents

What is an Invoice?

An invoice is a formal, commercial document that a seller issues to a buyer, detailing the products, quantities, and agreed-upon prices for goods or services provided. It serves as an official request for payment from the buyer to the seller. An invoice typically includes essential details such as the invoice number, date of issuance, the seller’s and buyer’s contact information, an itemized list of goods or services, unit prices, and the total amount due. Additionally, it may include payment terms, such as the due date for payment, accepted payment methods, and any applicable taxes or fees. Invoices are crucial for maintaining accurate financial records, ensuring timely payments, and providing legal evidence of the transaction.

How to draft an Invoice in Australia?

When drafting an invoice in Australia, it is important to include comprehensive details to ensure clarity and compliance with local regulations. The following elements should be included:

| ➤ Name, logo, and contact information for your company |

| ➤ A distinct invoice number |

| ➤ The invoice's creation date |

| ➤ The payment deadline and any additional payment requirements |

| ➤ All allowed payment methods |

| ➤ A thorough description of the items and services acquired, including price and quantity |

| ➤ The entire amount owing, including any applicable taxes and fees |