Ready to use legal template

Drafted by experienced lawyers

Compliant with Australian law

Ready to use legal template

Drafted by lawyers

Compliant with Australian law

Home › Business contracts › Shareholders agreement

Learn more about Shareholders Agreement in Australia

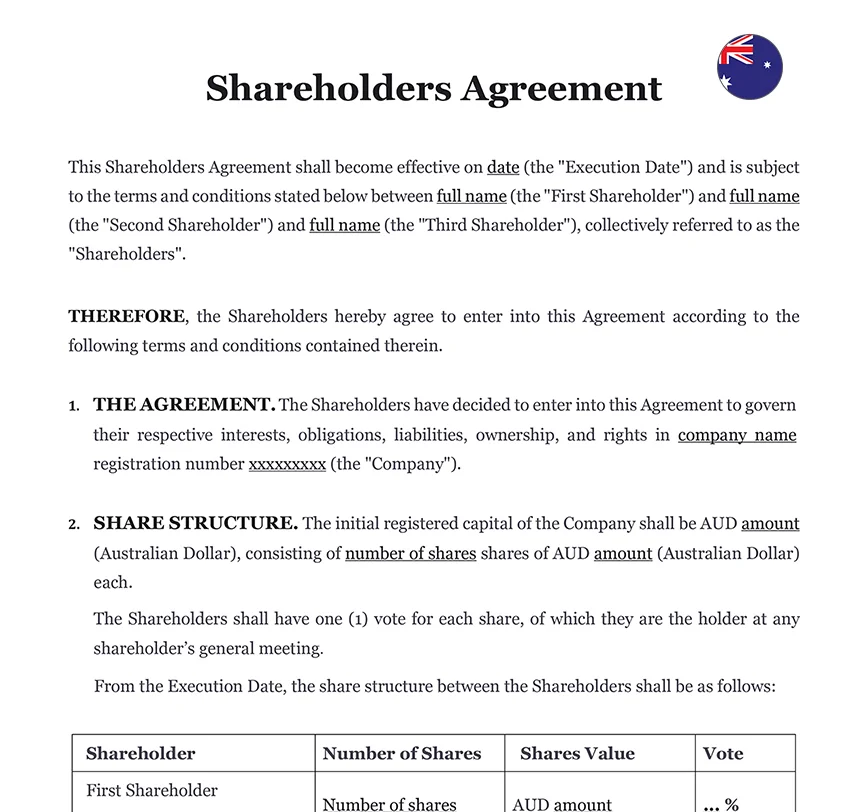

A Shareholders Agreement is a legally binding document that defines the rights, responsibilities, and obligations of shareholders in a company. It governs ownership structure, decision-making processes, share transfers, dividend distribution, and dispute resolution, ensuring transparency and protecting the interests of all parties involved. In Australia, having a well-drafted Shareholders Agreement is essential for preventing conflicts, safeguarding investments, and ensuring smooth business operations. This agreement provides clarity on corporate governance, voting rights, and exit strategies, helping shareholders manage their roles effectively while complying with Australian corporate laws. Download our Shareholders Agreement, easy to edit in Word format, drafted by legal experts for use in Australia.

Table of contents

-

What legal requirements must be met when drafting a shareholder agreement in Australia?

-

How does a shareholder agreement define the rights of shareholders in Australia?

-

What are the key components included in a shareholder agreement?

-

How does a shareholder agreement address issues like voting rights in Australia?

-

What provisions should be included to protect minority shareholders?

-

Are there specific regulations or laws governing shareholder agreements in Australia?

-

How can disputes among shareholders be resolved in Australia?

What legal requirements must be met when drafting a shareholder agreement in Australia?

In Australia, shareholder agreements must comply with various legal requirements to be valid and enforceable. These requirements typically include:

1. Compliance with Corporations Act:

Ensure that the agreement complies with the provisions of the Corporations Act 2001, which governs the rights and obligations of shareholders in Australian companies.

2. Clarity and Certainty:

The agreement should clearly outline the rights, responsibilities, and obligations of each shareholder, ensuring clarity and certainty in the terms and conditions.

3. Shareholder Consent:

The agreement should clearly outline the rights, responsibilities, and obligations of each shareholder, ensuring clarity and certainty in the terms and conditions.

4. Legal Formalities:

Follow proper legal formalities, including execution and witnessing of the agreement, to ensure its validity and enforceability in accordance with Australian law.

How does a shareholder agreement define the rights of shareholders in Australia?

A shareholder agreement in Australia defines the rights and responsibilities of shareholders by outlining various provisions related to:

1. Voting Rights: Specifies the voting rights of each shareholder, including voting thresholds for major decisions and procedures for voting on company matters.

2. Share Transfers: Sets out restrictions on the transfer of shares, such as pre-emption rights, drag-along and tag-along rights, and conditions for selling or transferring shares.

3. Dividend Entitlements: Specifies the entitlement of shareholders to receive dividends and distributions from the company’s profits.

4. Director Appointment: Addresses the process for appointing directors, their roles, responsibilities, and powers within the company.

5. Decision-Making Processes: Establishes procedures for decision-making, including board meetings, resolutions, and dispute resolution mechanisms.

What are the key components included in a shareholder agreement?

Shareholder agreements in Australia typically include several key components to govern the relationship between shareholders and the company. These components may include:

| ➤ Shareholder Rights and Obligations: Clearly define the rights, responsibilities, and obligations of each shareholder, including voting rights, share transfers, dividend entitlements, and director appointments. |

| ➤ Share Transfer Restrictions: Set out restrictions on the transfer of shares, such as pre-emption rights, tag-along and drag-along provisions, and conditions for selling or transferring shares. |

| ➤ Decision-Making Processes: Establish procedures for decision-making within the company, including voting thresholds, board meetings, resolutions, and dispute resolution mechanisms. |

| ➤ Confidentiality and Non-Compete: Include provisions to protect confidential information, intellectual property rights, and prevent shareholders from engaging in activities that may compete with the company. |

| ➤ Dispute Resolution Mechanisms: Outline procedures for resolving disputes between shareholders, including mediation, arbitration, or litigation processes. |