Ready to use legal template

Work on without any hassle

Compliant with Australian law

Ready to use legal template

Work on without any hassle

Compliant with Australian law

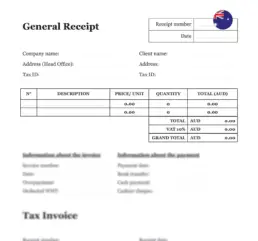

Home › Accounting › General receipt

Learn more about General Receipt in Australia

A General Receipt is a document that acknowledges the receipt of payment or goods for a specific transaction. It serves as a formal record between the payer and the payee, detailing the amount paid, the date of payment, and the purpose of the transaction. This document is essential for both individuals and businesses, providing a clear, legally recognized proof of payment. It can be used in various contexts, such as in commercial transactions, personal exchanges, or when issuing refunds. In Australia, a General Receipt helps to maintain accurate financial records and is crucial for tax reporting, audits, and resolving any future disputes. Download our General Receipt, easy to edit in Word format, expertly drafted to comply with Australian legal standards, ensuring accuracy and professionalism in your financial documentation.

Table of contents

What is a General Receipt in Australia?

In Australia, a General Receipt is a written acknowledgment provided by a seller or service provider to a buyer or client upon receiving payment for goods sold or services rendered. It serves as evidence of the transaction and typically includes details such as the amount paid, date of payment, description of the goods or services, and the parties involved.

How to draft a General Receipt in Australia?

When drafting a General Receipt in Australia, include the following elements:

| ➤ Date of issuance. |

| ➤ Names and contact information of the payer (buyer or client) and payee (seller or service provider). |

| ➤ Description of the goods sold or services rendered. |

| ➤ Total amount paid, including any taxes or fees. |

| ➤ Payment method (cash, cheque, credit card, etc.). |

| ➤ Signature or stamp of the payee as acknowledgment of receipt. |