Ready to use legal template

Work on without any hassle

Compliant with Australian law

Ready to use legal template

Work on without any hassle

Compliant with Australian law

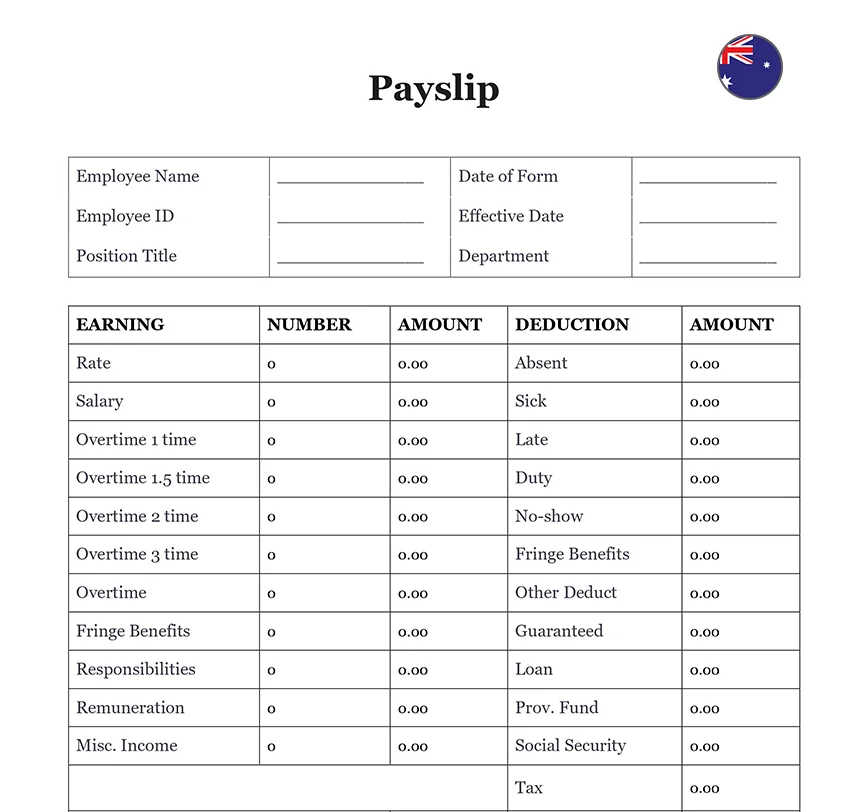

Home › Accounting › Payslip

Learn more about Payslip in Australia

A Payslip is a document provided by an employer to an employee that details the employee’s earnings, deductions, and net pay for a specific pay period. It typically includes information such as gross salary, tax withheld, superannuation contributions, and other benefits or deductions. In Australia, issuing payslips is a legal requirement under the Fair Work Act 2009, and they must be provided in a timely and accurate manner. Payslips play a crucial role in ensuring transparency between employers and employees and are essential for record-keeping, loan applications, and tax filing. Download our Payslip Form available in an easy to edit Word format and drafted by expert to be used in Australia.

Table of contents

What is a Payslip?

A payslip, often referred to as a pay stub or pay advice, is a document issued by an employer to an employee detailing the breakdown of their salary or wages for a specific pay period. Essentially, it provides a comprehensive record of an employee’s earnings and deductions, serving as a crucial financial document for both the employer and the employee.

Why is Payslip important in Australia?

Payslips hold significant importance in the Australian employment landscape for various reasons:

1. Legal Compliance:

In Australia, it’s a legal requirement for employers to provide employees with payslips within one working day of their payday. Failure to do so can result in penalties and legal consequences for employers.

2. Transparency and Accountability:

Payslips ensure transparency in wage payments, allowing employees to verify the accuracy of their compensation and understand how their pay is calculated. This promotes accountability in the employer-employee relationship.

3. Regulatory Compliance:

Payslips help employers comply with taxation and superannuation regulations by providing detailed information on income, taxes withheld, and superannuation contributions. They serve as essential documents for tax reporting and regulatory compliance.

4. Dispute Resolution:

In case of disputes or discrepancies regarding wages or deductions, payslips serve as crucial evidence to resolve issues between employers and employees. They provide a clear record of the agreed-upon terms of employment, helping to address any grievances effectively.

What does Payslip contain?

A typical payslip contains various pieces of information, including:

| ➤ Employee Details: Name, address, employee identification number, and other identifying information. |

| ➤ Pay Period: Dates covered by the payslip, usually indicating the start and end date of the pay period. |

| ➤ Earnings: Gross wages or salary earned by the employee during the pay period before any deductions. |

| ➤ Deductions: Details of any deductions withheld from the employee's pay, such as taxes, superannuation contributions, insurance premiums, or union dues. |

| ➤ Net Pay: The final amount of money the employee receives after all deductions have been subtracted from their gross earnings, often referred to as take-home pay. |

| ➤ Year-to-Date (YTD) Totals: Cumulative earnings and deductions for the current calendar year, providing a comprehensive overview of the employee's financial status. |