Why Tenant Screening is Crucial

Tenant screening is the process of evaluating potential renters to ensure they are financially stable, responsible, and likely to respect the property and rental agreement. Proper screening minimizes the risk of late payments, property damage, and legal issues, ensuring a smoother and more profitable rental experience. By investing time and resources into thorough tenant screening, landlords can avoid costly problems and foster a positive landlord-tenant relationship.

Establish Clear Criteria

Before starting the screening process, establish clear criteria for what constitutes an ideal tenant. This helps streamline the process and ensures consistency in evaluating all applicants.

1. Financial Stability: Look for tenants with a stable income that is at least three times the monthly rent. This ensures they can comfortably afford the rent and are less likely to default on payments.

2. Rental History: A good rental history indicates responsible behavior and respect for previous rental agreements. Prioritize tenants with positive references from former landlords.

3. Creditworthiness: A good credit score suggests financial responsibility. While not all potential tenants will have perfect credit, aim for a reasonable threshold that reflects responsible credit usage.

4. Background Check: Conduct background checks to identify any red flags such as criminal records or past evictions. This adds an extra layer of security and peace of mind.

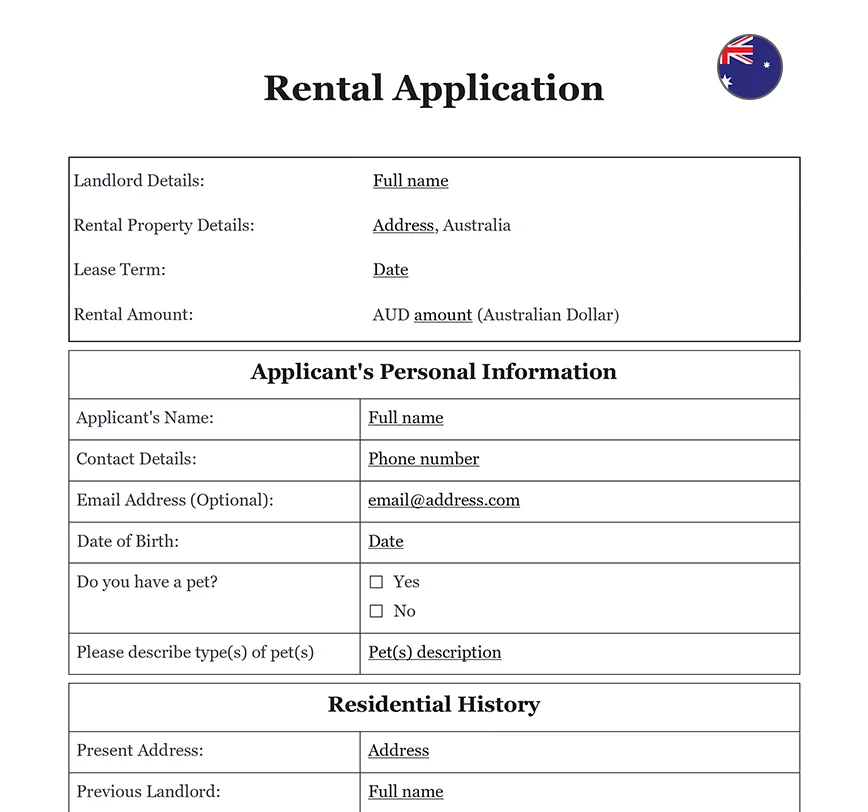

Create a Comprehensive Application Form

A detailed rental application form is essential for gathering all the necessary information about potential tenants. This form should include:

1. Personal Information: Full name, contact details, date of birth, and driver’s license or passport number.

2. Employment Information: Current employer, job title, length of employment, and income details. Request recent pay slips or employment contracts for verification.

3. Rental History: Details of previous rentals, including addresses, duration of tenancy, rent amounts, and contact information for former landlords.

4. References: Contact information for professional and personal references who can vouch for the applicant’s character and reliability.

5. Consent for Credit and Background Checks: Obtain written consent to perform credit checks and background investigations.

Verify Income and Employment

Verifying the applicant’s income and employment status is crucial to ensure they can afford the rent.

1. Pay Slips and Employment Contracts: Request recent pay slips or an employment contract to verify the applicant’s income. For self-employed individuals, ask for tax returns or bank statements.

2. Contact Employers: Contact the applicant’s employer to confirm their job title, length of employment, and income. Ensure that the information provided aligns with the application form.

3. Additional Income Sources: If the applicant has additional sources of income, such as freelance work or investments, request documentation to verify these earnings.

Conduct Thorough Background Checks

Background checks provide insights into an applicant’s history and help identify any potential red flags.

| ➤ Credit Check: Conduct a credit check to assess the applicant's financial responsibility. Look for any outstanding debts, late payments, or bankruptcies that may indicate financial instability. |

| ➤ Criminal Background Check: Perform a criminal background check to ensure the applicant has no serious criminal history. This step is vital for the safety and security of the property and other tenants. |

| ➤ Tenancy Database Check: Use tenancy databases, such as the National Tenancy Database (NTD) or TICA, to check for any history of rental disputes or evictions. |