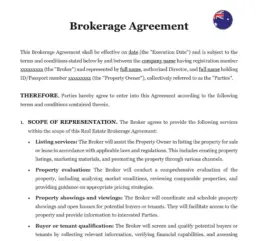

The Importance of a Brokerage Agreement

A brokerage agreement is a key document that outlines the terms of engagement between a client and a real estate broker. This contract specifies the services to be provided, the broker’s responsibilities, and the terms of compensation. This guide delves into the critical aspects of real estate brokers’ roles in Australia, emphasizing the significance of having a comprehensive brokerage agreement.

Defining the Broker's Role

The role of a real estate broker can vary significantly based on the type of transaction, whether buying, selling, leasing, or managing property.

1. Buyer Representation: Brokers represent buyers in finding and negotiating property purchases. They provide market analysis, property tours, and offer negotiation strategies.

2. Seller Representation: Brokers assist sellers in listing properties, marketing, setting prices, and negotiating sales. They often handle advertising, open houses, and communication with potential buyers.

3. Leasing Services: For rental properties, brokers help landlords find suitable tenants and assist tenants in finding rental properties. They may handle lease agreements and manage tenant relationships.

4. Property Management: Some brokers offer property management services, including rent collection, maintenance coordination, and tenant screening.

Scope of Services

The scope of services provided by a real estate broker should be clearly defined in the brokerage agreement.

1. Property Marketing: Outline the marketing strategies the broker will employ, such as online listings, print advertising, and open houses.

2. Negotiation: Specify the broker’s role in negotiating terms, including price, contingencies, and contract conditions.

3. Transaction Coordination: Detail the broker’s responsibilities in coordinating the transaction, such as handling paperwork, setting up inspections, and liaising with other professionals like attorneys and inspectors.

4. Advisory Services: Include any additional advisory services, such as market analysis, investment advice, or assistance with financing options.

Compensation and Fees

The brokerage agreement should clearly outline the broker’s compensation and how it will be calculated.

1. Commission Structure: Define the commission rate, whether it is a percentage of the sale price, a flat fee, or a combination. Clarify when the commission is earned and payable.

2. Additional Fees: Specify any additional fees, such as marketing costs, administrative fees, or retainer fees. Ensure that all costs are transparent and agreed upon upfront.

3. Split Commission: If the broker will be splitting the commission with other agents or brokers, outline the terms of this arrangement.

Duration and Termination of Agreement

The duration of the brokerage agreement and the conditions under which it can be terminated are crucial aspects to include.

| ➤ Term Length: Specify the duration of the agreement, whether it's a fixed term or ongoing until the transaction is complete. |

| ➤ Termination Clauses: Include conditions under which the agreement can be terminated, such as breach of contract, failure to perform duties, or by mutual consent. Outline the notice period required for termination. |

| ➤ Post-Termination Obligations: Detail any obligations that continue after termination, such as confidentiality or the payment of commissions on deals initiated during the agreement period. |