Ready to use legal template

Work on without any hassle

Compliant with Australian law

Ready to use legal template

Work on without any hassle

Compliant with Australian law

Home › Rent your property › Rent receipt

Learn more about Rent Receipt in Australia

A Rent Receipt is a written acknowledgment from a landlord to a tenant confirming the payment of rent for a specific period. This document serves as proof of payment and outlines the details of the transaction, including the amount paid, the date, and the rental property address. Rent receipts are essential for both tenants and landlords, as they provide legal documentation for rental payments and can be used for accounting, tax purposes, and resolving any potential disputes regarding payments. In Australia, issuing a rent receipt ensures transparency and helps to maintain a clear record of financial transactions. Download our Rent Receipt, easy to edit in Word format, expertly drafted to meet Australian legal standards and ensure accuracy in your rental agreements.

Table of contents

-

What is a Rent Receipt?

-

Why is a Rent Receipt important in Australia?

-

What information should a Rent Receipt include?

-

How is a rent receipt issued in Australia?

-

Is a Rent Receipt mandatory for rent payments in Australia?

-

Can a Rent Receipt be used for tax purposes in Australia?

-

What should tenants do if they haven't received a Rent Receipt?

What is a Rent Receipt?

In Australia, a Rent Receipt is an official document acknowledging the payment of rent from a tenant to a landlord. It serves as a crucial piece of evidence in rental transactions, providing a record of payment and ensuring transparency between both parties involved in the lease agreement. Rent receipts can take various forms, including paper receipts or digital receipts sent via email or text message. They are an essential component of proper record-keeping for both landlords and tenants, facilitating efficient financial management and helping to prevent disputes over rental payments.

Why is a Rent Receipt important in Australia?

Rent receipts play a vital role in the landlord-tenant relationship in Australia for several reasons. Firstly, they serve as proof of payment, helping tenants demonstrate that they have fulfilled their financial obligations under the lease agreement. This can be particularly important in the event of a dispute over rent payments or if there are discrepancies in rental records. Additionally, Rent Receipts provide landlords with documentation of rental income, which is essential for tax reporting purposes. By maintaining accurate records of rental payments, landlords can ensure compliance with Australian tax laws and avoid potential penalties or audits.

What information should a rent receipt in Australia include?

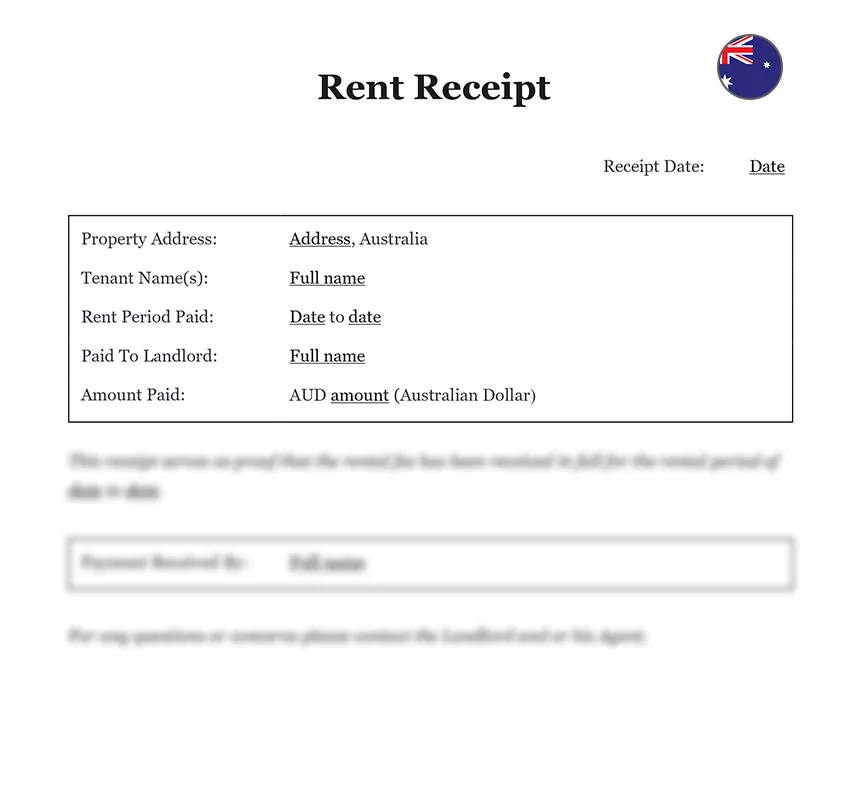

A Rent Receipt in Australia should contain essential details to accurately reflect the rental transaction. This includes the date of payment, amount paid, rental period covered, property address, names of both the landlord and tenant, and signatures. Including this information ensures that the Rent Receipt is legally valid and can be used as evidence in the event of a dispute. Additionally, some landlords may choose to include additional details on the receipt, such as payment method or reference numbers, for further clarity and documentation purposes.

How is a rent receipt issued in Australia?

Rent Receipts in Australia can be issued in various formats, depending on the preferences of the landlord and tenant. Traditionally, landlords may provide tenants with paper receipts at the time of payment, either in person or by mail. However, with the increasing prevalence of digital transactions, many landlords now opt to send rent receipts electronically via email or text message. This provides tenants with instant confirmation of payment and reduces the need for physical paperwork. Regardless of the format, it is essential that Rent Receipts are issued promptly and accurately to ensure compliance with Australian rental laws and regulations.

Is a Rent Receipt mandatory for rent payments in Australia?

While there is no legal requirement for landlords to provide Rent Receipts in Australia, it is highly recommended practice. Rent Receipts serve as a valuable record-keeping tool for both landlords and tenants, helping to document rental transactions and prevent disputes over payment. Additionally, some tenants may require Rent Receipts for their own financial management or to provide proof of rent payments to third parties, such as government agencies or financial institutions. By issuing Rent Receipts consistently and accurately, landlords can demonstrate their professionalism and commitment to transparent rental practices.

Can a Rent Receipt be used for tax purposes in Australia?

Yes, Rent Receipts can be used for tax purposes in Australia, particularly for landlords who report rental income on their tax returns. Rental income is considered taxable under Australian tax laws, and landlords are required to report it as part of their annual tax filings. Rent receipts provide landlords with documentation of rental payments, which can be used to support their tax deductions and ensure compliance with tax laws. Landlords should retain copies of all Rent Receipts issued throughout the tax year and include them as part of their financial records for tax reporting purposes.

What should tenants do if they haven't received a Rent Receipt?

If tenants have not received a Rent Receipt in Australia, they should take proactive steps to request one from their landlord. While landlords are not legally obligated to provide rent receipts, tenants are entitled to request documentation of their rental payments for their own records. Tenants can communicate with their landlord directly to request a rent receipt, either in person, by phone, or in writing. In some cases, landlords may be willing to provide electronic copies of Rent Receipts via email or text message for added convenience. If a landlord refuses to provide a rent receipt, tenants may wish to keep their own records of rental payments, such as bank statements or receipts from electronic payments, as evidence of payment.

SPECIAL OFFER

Landlord

10 Document Package

Essential documents for managing rental property in Australia

Rent ReceiptTemplate (.docx)

Easy and quick to customize

310 client reviews (4.8/5) ⭐⭐⭐⭐⭐

Share information

Why Themis Partner ?

Make documents forhundreds of purposes

Hundreds of documents

Instant access to our entire library of documents for Australia.

24/7 legal support

Free legal advice from our network of qualified lawyers.

Easily customized

Editable Word documents, unlimited revisions and copies.

Legal and Reliable

Documents written by lawyers that you can use with confidence.